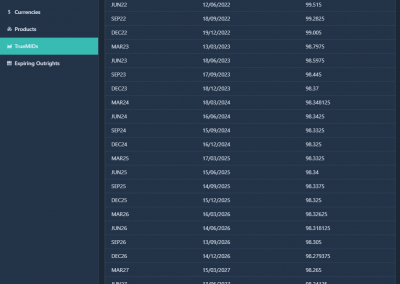

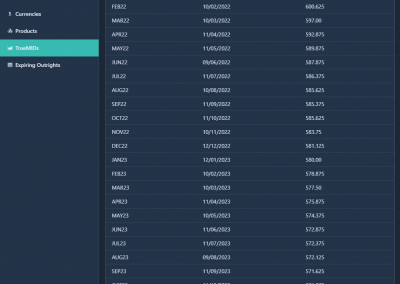

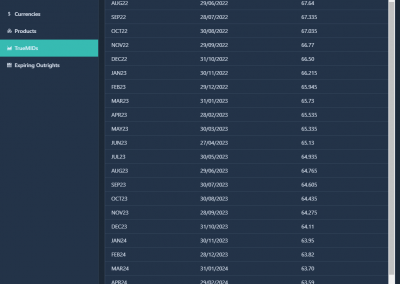

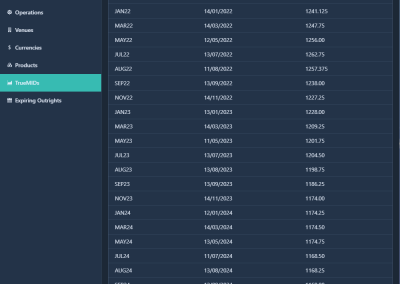

Data – trueMIDS

LiquidityWell Ltd (LW) has created pricing and execution software for the financial markets. LiquidityWell can produce universal implied prices using its fast, proprietary Matching Engine and complex mathematics.

For any listed exchange quoted product LW can create, for Data and for Execution: prices where there are none, better prices where there are some already, and an accurate calculation of a market mid-price (trueMid)

Markets within which we can provide this improved liquidity, include, but are not limited to Short Term Interest Rate Markets (STIRS), Energies, Precious Metals, Agricultural products.

Implication applies to any instrument with a term structure, on or off-exchange, such as FX, Energies, Commodities, Agricultural Markets, and STIRS (across outright, spreads, butterflies, double butterflies, and condors). Equally adapted to OTC fixed-income trading.

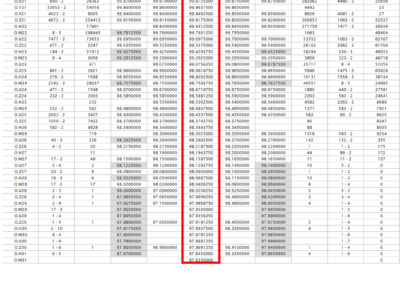

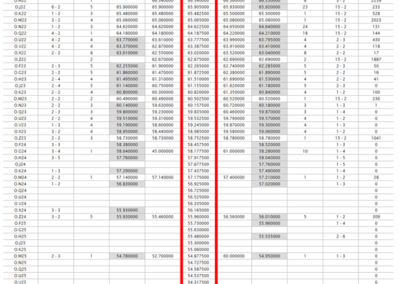

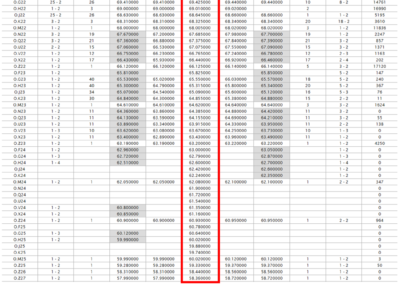

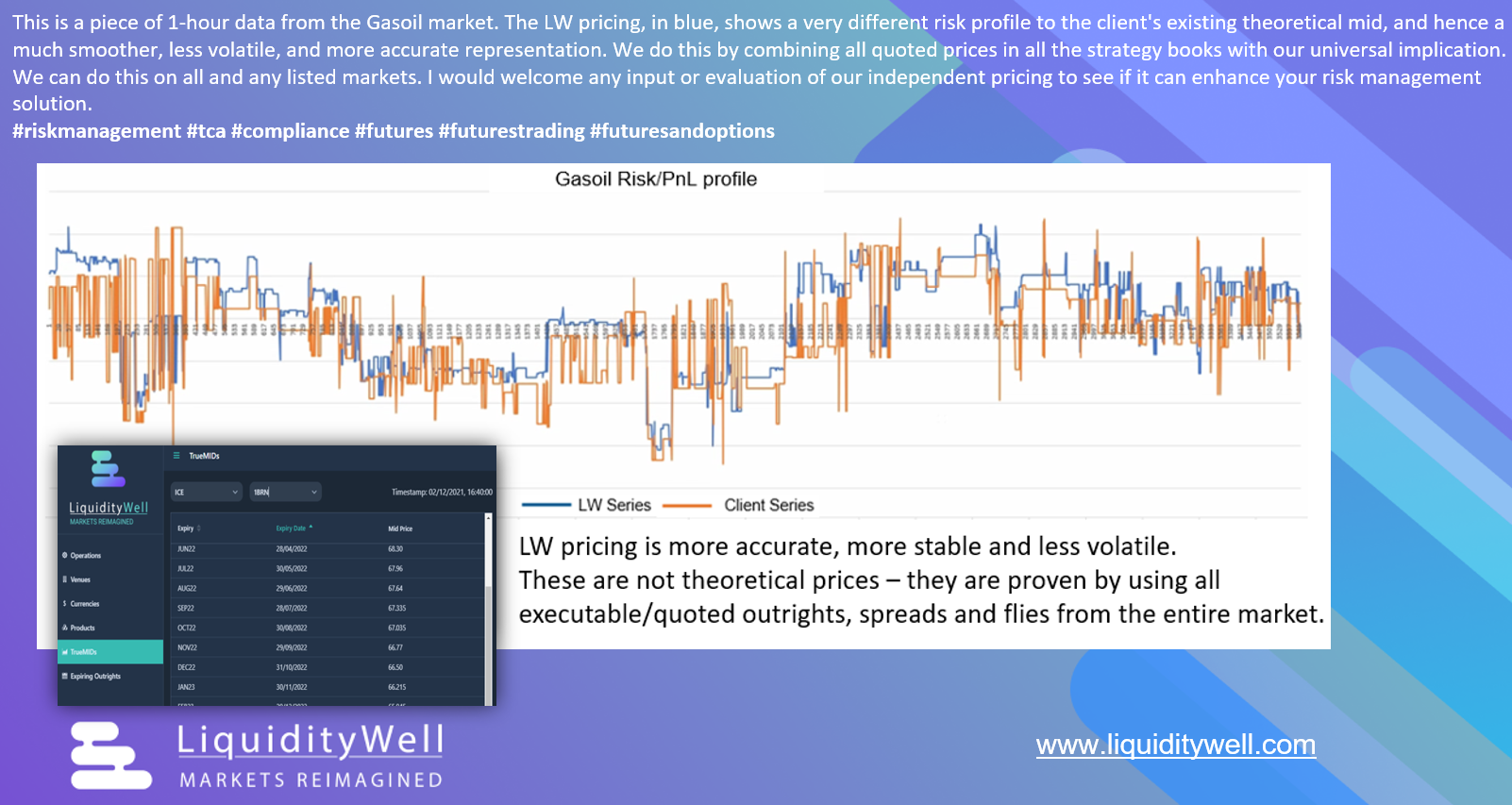

LW trueMid Theoretical Curve: LW has created a mid-curve for derivatives products using all the executable unseen implied prices across all the strategies (spreads, butterflies, double butterflies, condors) to plot a curve.

The result is a view of the market which can be used to highlight areas of the curve that are misaligned and likely to trade. These trueMids are superior to standard VWAP mid-prices. VWAP can, and are often, manipulated and they are generated only by the prices in that one instrument. Our trueMids are supported by all strategies that feed into that instrument – hence more information is used to calculate and reinforce each trueMid.

These trueMids, being reinforced by all the strategies and orders across the entire market, are more persistent and more accurate than the individual instrument mid-prices that are often manipulated and volatile.

LW provides the ability to build better curves and more accurately measure risk – of significant interest to Risk Managers, Compliance, Best Execution, and Market Makers.

Gasoil PnL Profile – Client Case Study

Data Analytics

LW analytics combines its proprietary Matching, Aggregation, and Implication engines agnostically across futures, swaps and, bond markets to derive and display hidden liquidity and price improvements.

These engines can publish out to our cloud-hosted platforms or run in a headless guise, providing the analytical output directly into your internal systems.

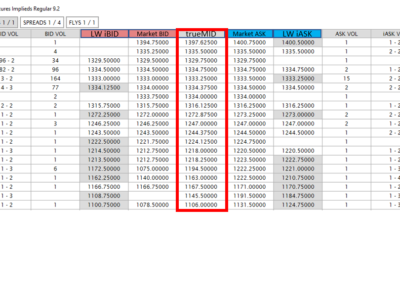

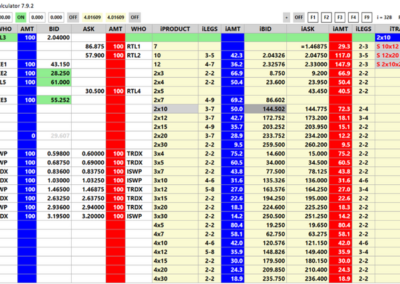

Futures Implied Calculator:

Execution Management System to trade on better prices and more liquidity on Exchange.

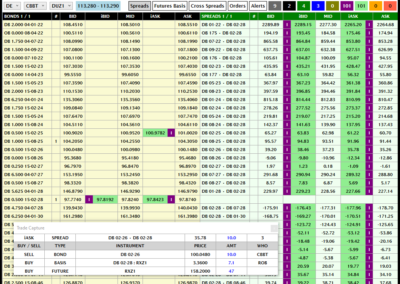

EGB Implied Calculator:

European Government Bond collaborative pricing tool. Duration matched bond and futures cross pricing.

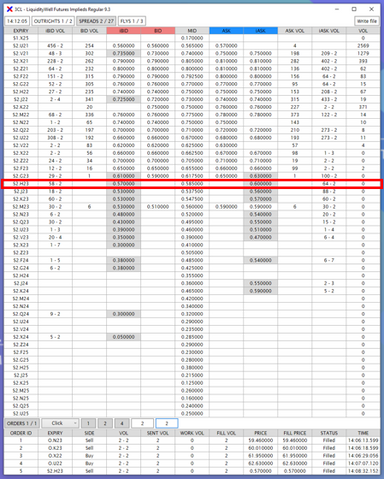

IRS Implied Calculator:

Duration match implied IRS derivative, collaborative whiteboard pricing tool with STP ticketing.

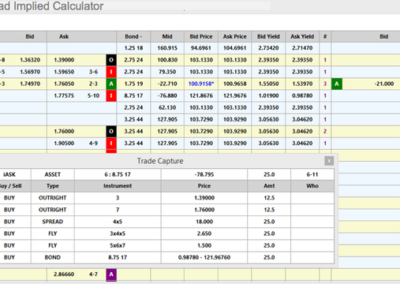

Swap Spread Implied Calculator:

Cross price bonds and swaps implying out swap spreads.

AI

Machine Learning: LiquidityWell will analyse our unique price data using AI and Machine Learning (ML) to explore the potential of predicting future price patterns. The project is starting in the last quarter of 2021 and is an exciting and potentially transformational capability added to our product suite.

The AI/Machine Learning opportunity is huge. This data input which initially uses structured “implied” liquidity, may, in time be widened to unstructured data events. We have already located an AI vendor ready to offer resources and services to help pilot a research project using our data products. The ability to use existing price liquidity on a real-time basis with AI models to then generate predictive, future price path expectations can be applied to all of the LW markets.

A predictive price ability, driven by existing data liquidity, would be of huge value and interest to financial institutions of all varieties – hedge funds, banks, pension funds, macro funds, market makers, and exchange institutions.

Our Office

Address: 86 - 90 Paul Street, 3rd Floor, London. United Kingdom. 3rd Floor, EC2A 4NE

Contact Us

+44 (0) 333 011 3665

info@liquiditywell.com

Office Hours

Mon-Fri: 9am - 5pm

Sat-Sun: Closed